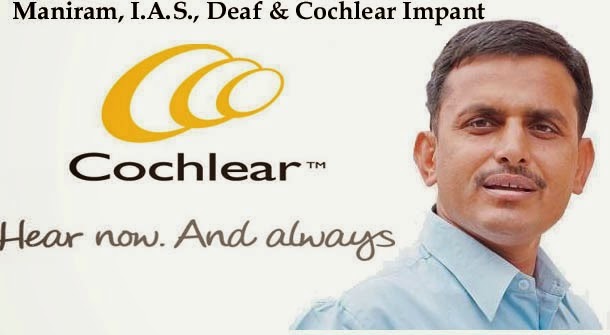

Maniram Sharma has won a 15-year-old battle for justice. On Thursday ( 8th October 2009 ), this deaf IAS candidate learnt he has made it to the Civil service. With this, Maniram has not just won a personal battle but a milestone victory for disabled persons like him who have been kept away from the premier government service.

Maniram’s case has been highlighted by Times of India over the past couple of years — how his efforts were thwarted on one ground or the other, till he finally went through surgery to make his aided hearing so good that he gave his IAS interview this time by the oral question-and-answer method. Despite this, his induction into the service was just not happening.

While other successful candidates got their call on August 17, he didn’t. Finally, on September 3 he was informed that he had cleared the exam on all counts but still had to wait for another month to get his appointment. “I still can’t believe it has happened. It has not sunk in. After suffering so many disappointments, it’s difficult to imagine it has actually come true,” Maniram told TOI.

Maniram’s IAS saga began in 1995 when he failed in his first attempt to clear the preliminary examination. He was then 100% deaf. Since then he has cleared the exam three times — 2005, 2006 and 2009. In 2006, he was told he could not be allotted the IAS as only the partially deaf were eligible, not fully deaf persons like him.

so,To improve his hearing, Maniram had a surgical cochlear implant, costing Rs 7.5 lakh that now enables him to hear partially. He appeared for the IAS again this year and cleared it, scoring the highest in the hearing-impaired category. Yet, he faced several more hurdles as the government put technical hurdles questioning his level of disability.

Anyway, this story has a happy ending. And Maniram has no complaints. “If I could wait for 15 years, I could surely wait for a few more months. But the uncertainty kept me on edge,” he said without rancour. He is off to his village Badangarhi in Alwar district, Rajasthan, to convey the news to his family. “I have decided to go in person to tell them. My whole village will celebrate.”

Maniram’s Badangarhi is a remote village which doesn’t even have a school. He started losing his hearing at the age of five, becoming totally deaf by nine. His parents, both illiterate farm labourers, could do little to help. Yet, Maniram continued trudging to the nearest school, 5km away, and cleared class 10 standing fifth in the state board examination and cleared class 12 ranking seventh in the state board.

In his second year in college, he cleared the Rajasthan Public Service Commission (RPSC) examination to become a clerk-cum-typist. He studied and worked during his final year and topped the university in Political Science. He went on to clear the NET (National Eligibility Test).

He then gave up his RPSC job and became a lecturer. Not satisfied with that, he became a Junior Research Fellow and completed his Ph.D in Political Science during which time he taught M Phil and MA students in Rajasthan University. Having completed his Ph.D, Maniram got through the Rajasthan Administrative Service (RAS) and while in service he started trying for the UPSC.