30

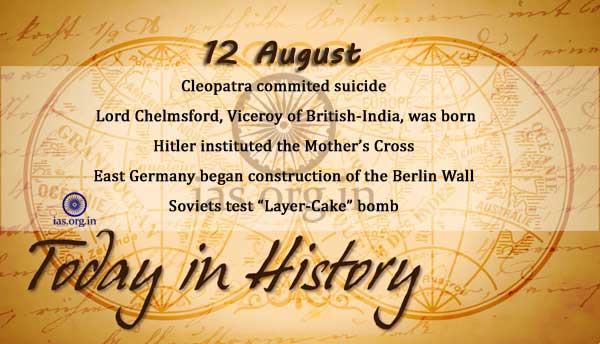

Cleopatra, queen of Egypt and lover of Julius Caesar and Mark Antony, took her life following the defeat of her forces against Octavian, the future first emperor of Rome.

1602

Abul Fazal, Akbar‘s minister, was killed on the instructions of Jahangir.

1868

Frederick JNT Lord Chelmsford, Viceroy of British-India (1916-21), was born.

1898

The brief and one-sided Spanish-American War came to an end when Spain formally agreed to a peace protocol on U.S. terms: the cession of Cuba, Puerto Rico, and Manila in the Philippines to the United States pending a final peace treaty.

1914

A week after Britain declared war on Germany and entered the First World War, the British Parliament passed the Defense of the Realm Act, aimed at providing the British government with the means to support the country’s war effort.

1919

Dr. Vikram Ambalal Sarabhai, the father of Indian space technology and scientist, was born at Ahmedabad.

1928

The Olympic Games hosted by Amsterdam fully realized Pierre de Coubertin’s vision: ‘the nations of the world in friendly competition’. After a succession of Olympics dominated by North America and Western Europe, Amsterdam welcomed more than 3,000 competitors.

1946

Viceroy announced invitation to Congress to form provisional Government.

1953

Less than one year after the United States tested its first hydrogen bomb, the Soviets detonate a 400-kiloton device in Kazakhstan. The explosive power was 30 times that of the U.S. atomic bomb dropped on Hiroshima, and the mushroom cloud produced by it stretched five miles into the sky. Known as the “Layer Cake,” the bomb was fueled by layers of uranium and lithium deuteride, a hydrogen isotope. The Soviet bomb was smaller and more portable than the American hydrogen bomb, so its development once again upped the ante in the dangerous nuclear arms race between the Cold War superpowers.

1961

In an effort to stem the tide of refugees attempting to leave East Berlin, the communist government of East Germany begins building the Berlin Wall to divide East and West Berlin. Construction of the wall caused a short-term crisis in U.S.-Soviet bloc relations, and the wall itself came to symbolize the Cold War.

1964

On August 12, 1964, Charlie Wilson, part of the gang who pulled off the 1963 Great Train Robbery, one of the biggest heists of its kind, escaped from Winson Green Prison in Birmingham, England.

1990

On this day in 1990, fossil hunter Susan Hendrickson discoverd three huge bones jutting out of a cliff near Faith, South Dakota. They turn out to be part of the largest-ever Tyrannosaurus rex skeleton ever discovered, a 65 million-year-old specimen dubbed Sue, after its discoverer.

1991

Parliament passed the Terrorist and Disruptive Activities (prevention) amendment bill.

1997

Bar Council of India debars full-time law teachers from practising as lawyers.

1997

Gulshan Kumar of Super Cassette Industries was shot dead by four unidentified persons in north-west Mumbai.

2000

Neelam Jaswant Singh heaves the discus to a National mark (59.53m) in the Travancore National circuit athletics meet in Thiurvananthapuram.

Related Articles: