➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖

A Cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand. It is an unconditional order in writing ,drawn by a customer on his bank, requesting the specifying bank to pay on demand a certain sum of money to a person named in the cheque or to the bearer or to the order of a stated person.

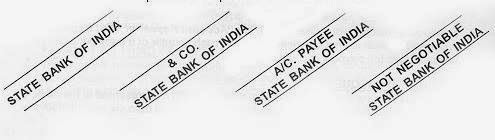

Crossing of a cheque means two transverse parallel lines are drawn on the left hand corner of the cheque. A crossing of the cheque is a direction of paying money to the banker not to the holder at the counter. A cheque can be made safe by crossing it. Crossing prevents fraud and wrong payments.

Types of Cheque Crossing:

[1] General Crossing: A cheque is said to be crossed generally when it bears across its face any of the following:

[1] Two transverse parallel lines.

[2] Two transverse parallel lines with the word “And Company” or “And Co”.

[3] Two transverse parallel lines with any abbreviation of the word “& Company”.

[4] Two transverse parallel lines with the words “Not Negotiable”.

[5] Two transverse parallel lines with the words “Account Payee Only”.

The cheque crossed generally does not ceases to be negotiable further. The collecting banker can collect the proceeds of the cheque in the account of that person mentioned on the cheque. A crossed cheque can be made bearer cheque by cancelling the crossing and writing that the crossing is cancelled and affixing the full signature of drawer.

[2] Special Crossing: It is a cheque in which the name of the bank is written between the two parallel lines and hence it can be paid to that specific banker only. Inclusion of the name of a banker is essential in special crossing . Special Crossing can never be converted to General Crossing. In Special Crossing paying banker to honor the cheque only when it is presented through the bank mentioned in the crossing and no other bank.